Especially if your accountant ends up telling you you’ve been using them incorrectly for the past year. bookkeeping is a crucial function of accounting, and earning a bookkeeping certification is a great way to show employers your expertise. While a certificate is not a requirement to become a bookkeeper, some professionals pursue certification to show their skills to employers and stand out in their job search.

A free online bookkeeping course

There are several effective ways to manage bookkeeping responsibilities in-house or externally by using helpful tools and technologies. Double-entry is more complex, but also more robust, and more suitable for established businesses that are past the hobby stage. When you’re stuck in the minutiae of reconciling your transactions, this won’t feel like “seven easy steps”. If your bookkeeper bills your customers or pays your vendors and employees, make sure you have proper checks and balances in place to mitigate the possibility of fraud.

- Outsourcing your bookkeeping is another option, and this guide on how to find the best virtual bookkeeping service can help you get the process started.

- Remote work has expanded across nearly every field, including bookkeeping.

- But for the sake of explaining the basics of bookkeeping, here are the first seven steps you’ll need to walk through to get your bookkeeping machine humming.

- Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes.

- As a bookkeeper, you will verify and balance receipts, keep track of cash drawers, and check sales records.

- Purchase receipts should always be kept as proof that the purchases took place.

Bring Your Bookkeeper Up to Speed

Your bookkeeper might also prepare other auxiliary reports for your business, like accounts payable and accounts receivable aging reports. You can use these to make business decisions, but they should not be presented as audited, certified or official financial statements. A bookkeeper is responsible for identifying the accounts in which transactions should be recorded.

Are bookkeeping and accounting different?

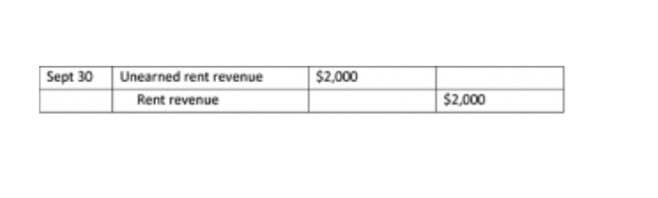

- The debited account is the one that receives or loses value, and the credited account is the one that gives or gains value.

- You can earn either certification by passing a four-part multiple-choice exam, agreeing to abide by a professional code of conduct, and verifying your bookkeeping accounting education and experience.

- On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done.

- The way you categorize transactions will depend on your business and industry.

- Most accounting software today is based on double-entry accounting, and if you ever hire a bookkeeper or accountant to help you with your books, double-entry is what they’ll use.

While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional. It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. An accounting degree requires deep education and training in tax and other laws with which businesses need to comply, plus finance and business management. While some bookkeepers may have developed similar skills, that level of training isn’t required to be called a bookkeeper. The specific amount of an emergency fund may depend on the size, scope, and operational costs of a given business.

Set up budgets

Although bookkeeping is an investment, it’s generally much more affordable than attempting to correct costly mistakes down the road. If Bench does your bookkeeping, you can also upload and store as many digital receipts and documents as you’d like in the Bench app. Every transaction you make needs to be categorized and entered into your books. These days, you’ve got three options when it comes to bookkeeping tools. The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited. The more information (and supporting documents) you can give your CPA at tax time, the more deductions you’ll be able to legitimately claim, and the bigger your tax return will be.

- Wondering how best to collect and track financial information, deal with expense management, and ensure healthy cash flow for your business?

- You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping.

- A separate bank account is the first step in distinguishing between business and personal finances.

- Many accountants also prepare tax returns, independent audits and certified financial statements for lenders, potential buyers and investors.

Statement of Participation

Though having a two-year or four-year degree isn’t always required to be hired as a bookkeeper, some companies may prefer candidates who do. Certifications aren’t necessary to become a bookkeeper but can signal to employers that you have the training and knowledge to meet industry standards. After you have a few years of experience, you can earn the Certified Bookkeeper designation from the American Institute of Professional Bookkeepers by passing a series of exams. If you’re a detail-oriented individual who enjoys working with numbers, then you might consider a career as a bookkeeper.

types of bookkeeping for small businesses

Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity. Many bookkeeping software options automate the tracking process to eliminate errors. Bookkeepers are integral to ensuring that businesses keep their finances organized. If you’re interested in a career as a bookkeeper, consider taking a cost-effective, flexible course through Coursera. At the end of the course, you’ll receive a professional certificate, which you can put on your resume to demonstrate your skills and accomplishments to potential employers.

What is a bookkeeper’s job?

Assets in Accounting

Dover NJ hit with ‘financial disaster’ after bookkeeping error – Daily Record

Dover NJ hit with ‘financial disaster’ after bookkeeping error.

Posted: Wed, 21 Feb 2024 08:00:00 GMT [source]